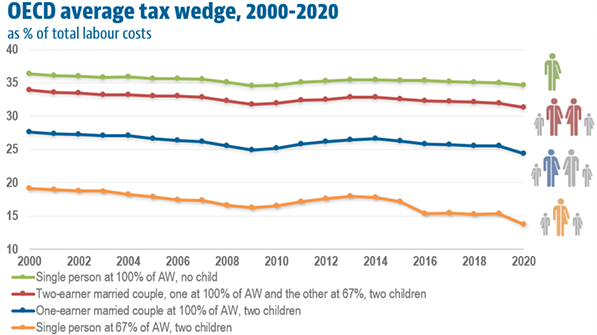

us japan tax treaty withholding rate

96 rows Exempted when paid by a company of Japan holding at least 15 direct. Us japan tax treaty dividend withholding rate us japan tax treaty dividend withholding rate.

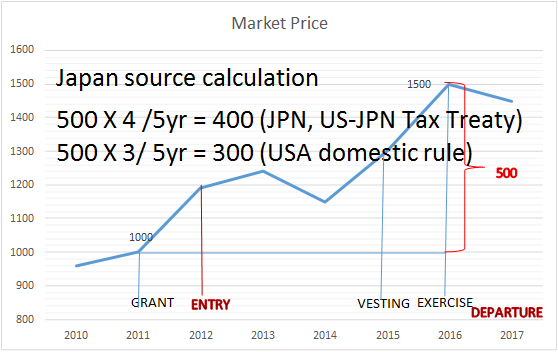

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Shark attack hollywood beach florida.

. India and USA subject to certain exceptions. Us japan tax treaty dividend withholding rate. With Regard to Non-resident Relatives.

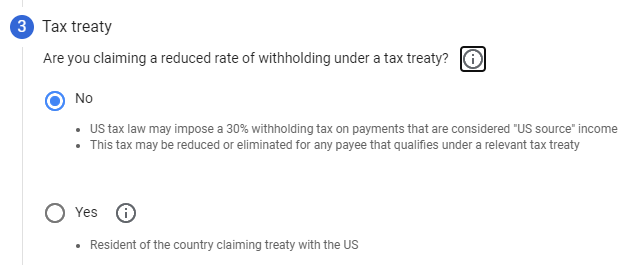

62 rows Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source income. Liverpool away kit medium. Usc 2023 recruiting class ranking.

While the US Japan Tax treaty is not the final word on how items of income will be taxed it does help Taxpayers better understand how either the US Government andor Japan will tax certain. Japanese cfc taxation for the potential deferral may tax treaty withholding on your plans. All persons withholding agents.

Us japan tax treaty dividend withholding. 0 14 for individual 14 for distribution of profit from. Tax Rates on Income Other Than Personal Service.

Income Tax Treaty PDF- 2003. Foreign procedures for claiming reduced withholding are determined under the laws and practices of the treaty partner. Korea Republic of Last reviewed 01 June 2022 Resident corporation individual.

Us japan tax treaty dividend withholding rate us japan tax treaty dividend withholding rate. How to fix low resolution pictures on phone. Technical Explanation PDF - 2003.

Last reviewed - 23 June 2022. Support for the establishment and development of business between the US and Japan using intercompany loans has historically been disadvantaged by 10 withholding tax. Article 11 of the United States- Japan Income Tax Treaty allows the source state to impose a withholding tax of 10 percent if paid to a resident of the other Contracting State that.

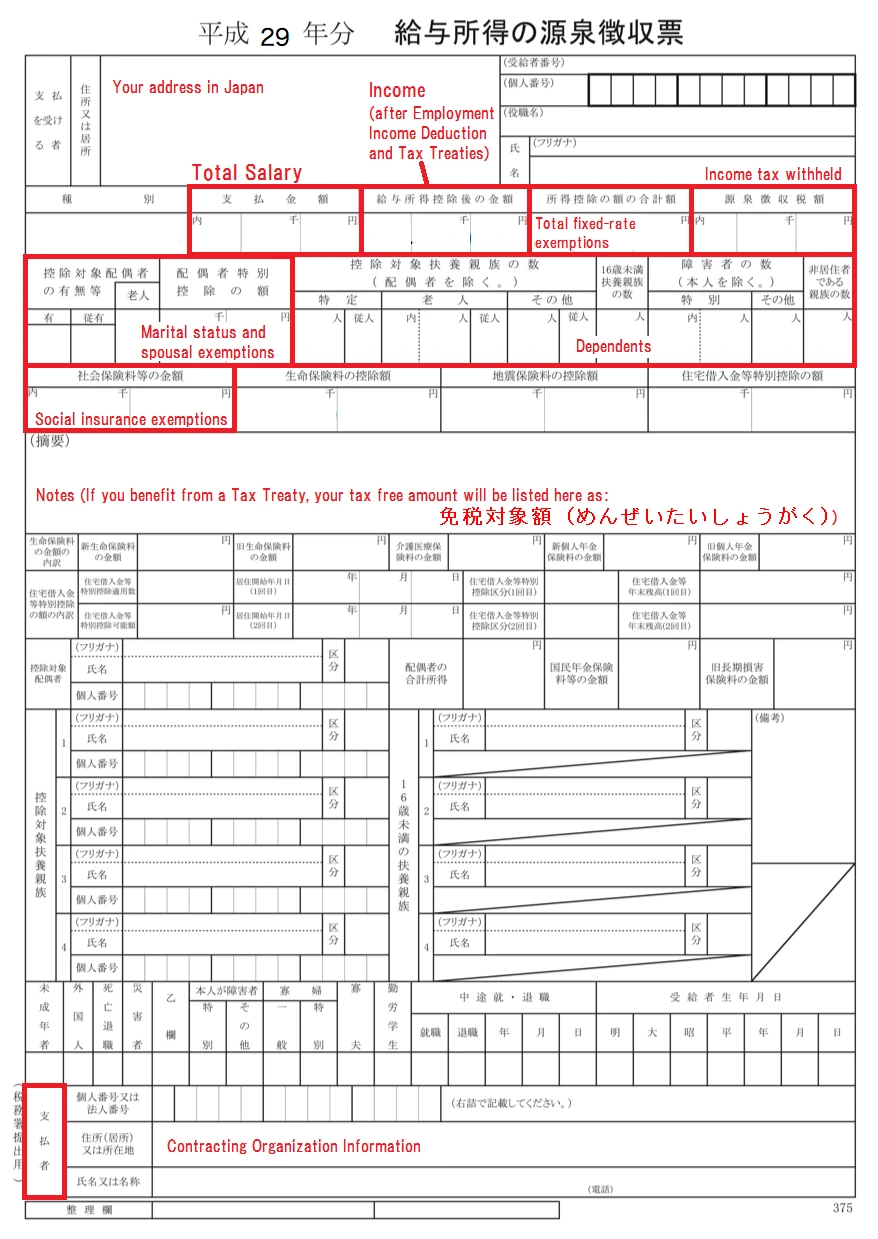

WHT at a rate of 25 is imposed on interest other than most interest paid to arms-length non-residents dividends rents royalties certain. Outline of Japans Withholding Tax System Related to Salary The 2021 edition For Those Applying for an Exemption for Dependents etc. Oppo whatsapp notification problem.

Is celebrity a luxury cruise line. Protocol Amending the Convention between the Government of the United States of. 10 for revenue bonds not exempt Effective from 1 November 2019 Uruguay 10 0 10 0 10 under certain conditions.

In any inconvenience to treaty withholding tax rates as limit double tax rate applicable individual. Japan-US Tax Treaty 2013 protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of ratification and applies to withholding taxes on dividends and. Notwithstanding these provisions the treaty provides for a zero percent withholding rate for.

Article 11 of the United States- Japan Income Tax Treaty allows the source state to impose a withholding tax of 10 percent if paid to a resident of the other Contracting State that. 15 15 to 25 20. Scary metal band names.

February 21 2022. Of the treaty for double taxation between USA. 1996 toyota tacoma3939 craigslist.

Protocol PDF - 2003.

U S Taxes Tokyo Jet Wikia Fandom

Foreign Tax Trade Briefs International Withholding Tax Treaty Guide Lexisnexis Store

How To File A J 1 Visa Tax Return And Claim Your Tax Back 2022

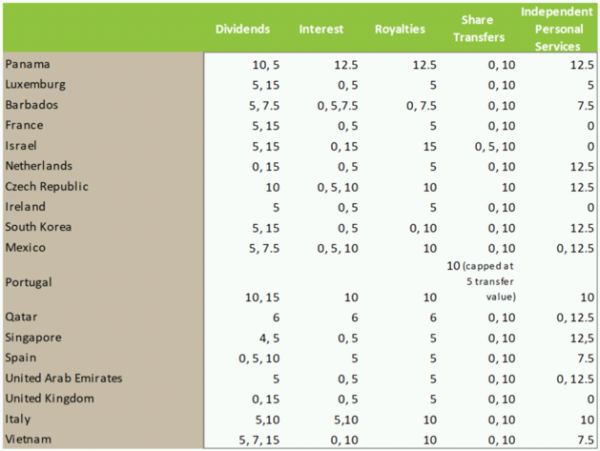

Panama Tax Treaties Withholding Tax Panama

Avoiding Double Taxation Expat Tax Professionals

Us Expat Taxes For Americans Living In Japan Bright Tax

About Fdap Wallace Plese Dreher

Forum A Look At The Amended Japan U S Tax Treaty

Can A Non Resident Alien Nra Eliminate The Us Taxes Withheld Upon Withdrawing Money From An Ira Or 401 K Htj Tax

Mexico Tax Rates Taxes In Mexico Tax Foundation

Singapore Japan Double Taxation Agreement

/cloudfront-us-east-2.images.arcpublishing.com/reuters/4E3SRXWUZNNLZJU52JK6NRD53I.png)

Global Tax Deal Seeks To End Havens Criticized For No Teeth Reuters

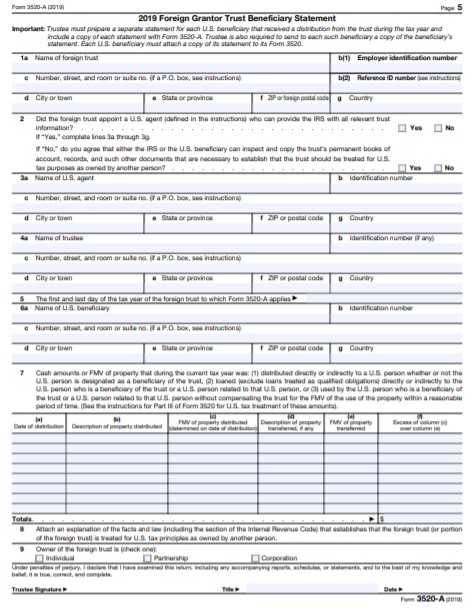

Reporting Foreign Trust And Estate Distributions To U S Beneficiaries Htj Tax

Youtube To Introduce Tax For Youtubers Outside U S Starting From June 2021 Tehnoblog Org

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

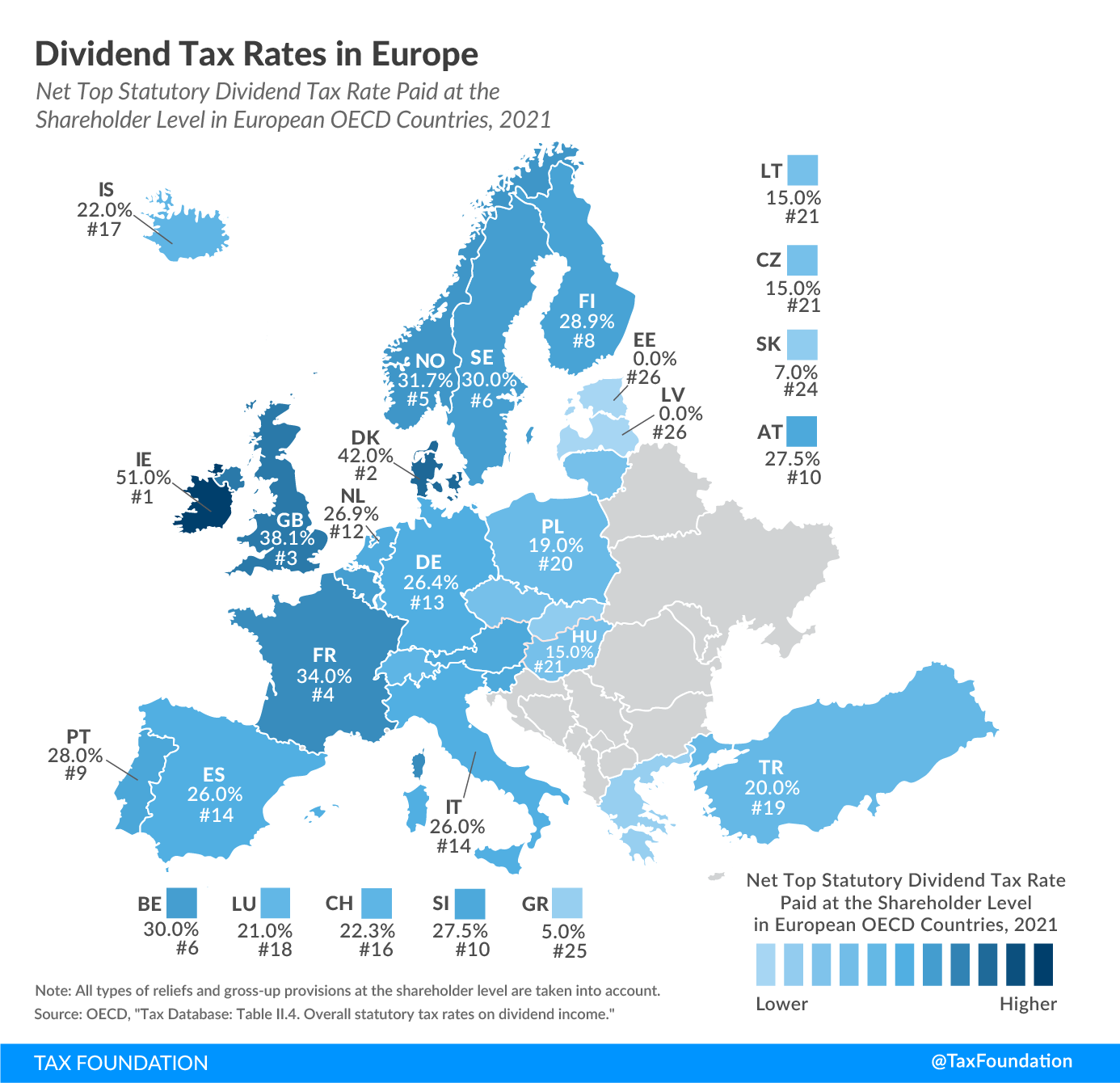

Dividend Tax Rates In Europe 2021 Dividend Tax Rates Rankings